The Itinerary

Here are a few places you can visit (some are affiliate links) to reconstruct or build credit for the first time. To start, this link isn’t an affiliate, but you can get your credit reports free at annualcreditreport.com.

Credit Builder Card

A secured card will lead you in the right direction. It’s important to keep your card below 10%. To add, this option requires you to provide a cash security deposit, usually equal to your credit line. Other fees may apply, execute due diligence and mail in payments a few weeks before due date if you select CBC.

We partnered with Credit Builder Card, and they report to all three credit agencies, Equifax, Experian and TransUnion. Just a reminder, we’re a subsidiary of Land Enterprises, LLC. I personally think a secured card via your bank is the best way to go. However, if that isn’t an option CBC is fine.

An option I have used in the past is Discover It. I can pay my bill online, no hidden fees, my deposit was returned in less than a year and my limit was increased after responsible use. I really love using Discover, and my score increased due to good financial habits as well.

Additionally, Capital One is a great card when building credit. They offer secured cards as well.

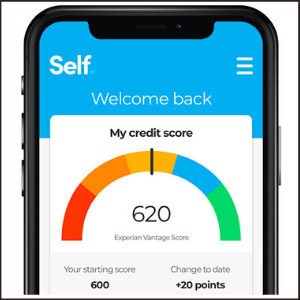

Self Inc.

An alternative to a secured card is Self Inc. They don’t require an upfront deposit. Additionally, Self reports your payments to the three major credit agencies. You don’t have access to the funds, however, a late payment will negatively effect your credit. So, select a monthly plan for your budget.

Kikoff

Kikoff does not conduct a credit check during the application review process, so there is no need to be concerned about your credit scores. They offer different products, therefore, you’ll have a credit mix which could optimize your score.

Credit Monitoring

A credit monitoring service tracks changes in borrower behavior to notify consumers of potential fraud, as well as changes to their creditworthiness. I’ve used a few, but honestly your bank or credit card will give you alerts free.

General Dispute Resolution Tips

Shelly Land recently embarked on her own financial restructuring/literacy journey. Now, she offers an eBook $19.99 General Dispute Resolution Tips. You can purchase here. Also, she launched a financial literacy book to share with your children it’s $14.99. There is other merchandise available via her Spring shop. Follow us on YouTube.